Merck & Co., Inc. (MRK) Files 424B5 Prospectus Supplement for $8 Billion Debt Offering

December 3, 2025 Merck & Co., Inc. (MRK)Not investment advice. Facts sourced from SEC 424B5.

📋 Filing Summary

| Company | Merck & Co., Inc. (MRK) |

| Filing | 424B5 — 2025-12-03 |

| Subject | Debt securities offering [Cover Page] |

| Amount | $8,000,000,000 [Cover Page] |

| Use of Proceeds | General corporate purposes, potentially funding Cidara acquisition [Cover Page] |

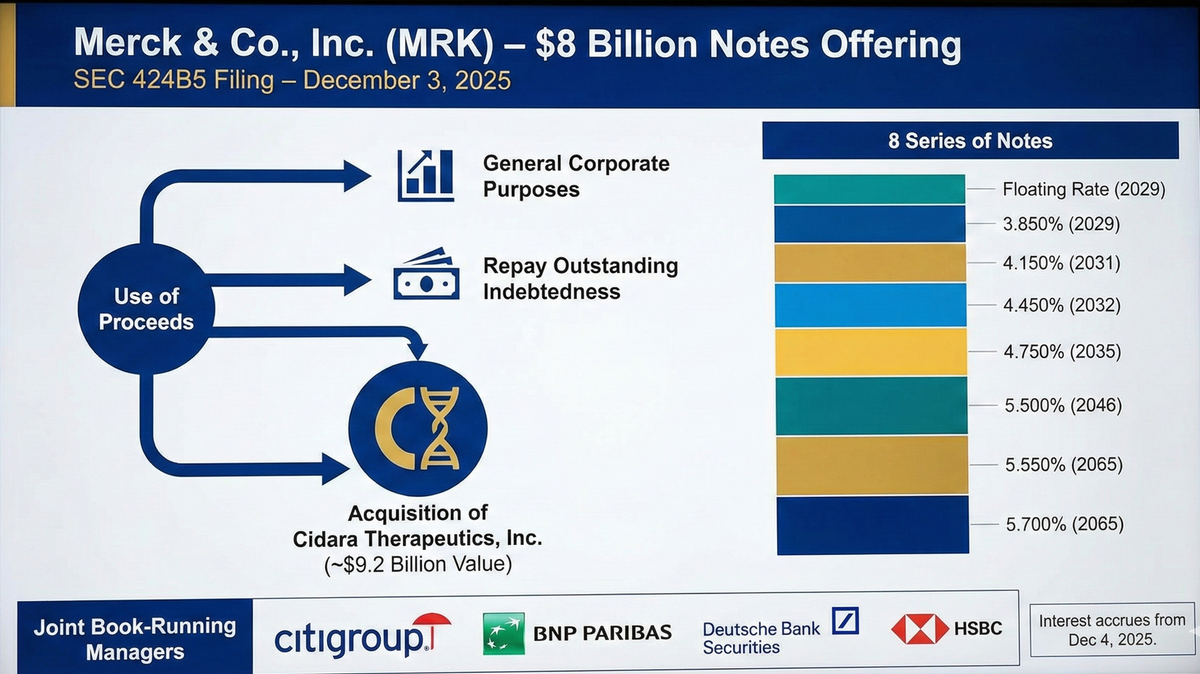

Merck & Co., Inc. (MRK) disclosed an offering of $8,000,000,000 in notes in an SEC 424B5 filing dated 2025-12-03. [Cover Page]

According to the filing, the company intends to use the net proceeds for general corporate purposes including, without limitation, to repay outstanding indebtedness, as well as potentially to fund a portion of the cash consideration and related fees and expenses payable in connection with the acquisition of Cidara Therapeutics, Inc. [Cover Page]

The filing states that on November 14, 2025, Merck announced a definitive agreement to acquire Cidara Therapeutics, Inc. for $221.50 per share in cash for a total transaction value of approximately $9.2 billion, subject to a majority of Cidara's stockholders tendering their shares in a tender offer. [Prospectus Supplement, page S-2]

The offering consists of eight series of notes: $500,000,000 aggregate principal amount of Floating Rate Notes due 2029, $750,000,000 aggregate principal amount of 3.850% Notes due 2029, $1,000,000,000 aggregate principal amount of 4.150% Notes due 2031, $1,000,000,000 aggregate principal amount of 4.450% Notes due 2032, $1,500,000,000 aggregate principal amount of 4.750% Notes due 2035, $750,000,000 aggregate principal amount of 5.500% Notes due 2046, $1,500,000,000 aggregate principal amount of 5.550% Notes due 2055 and $1,000,000,000 aggregate principal amount of 5.700% Notes due 2065. [Page 34]

Interest on the notes will accrue from December 4, 2025. [Cover Page]

The filing states that the principal amount of indebtedness of Merck's subsidiaries totaled $5.7 billion as of September 30, 2025. [Prospectus Supplement, page S-3]

According to the filing, Jennifer Zachary, Executive Vice President and General Counsel, will pass upon the validity of the notes with respect to New Jersey law. [Item 2.05] As of November 21, 2025, Ms. Zachary owned, directly and indirectly, 56,899.018 shares of Merck common stock, 8,854 restricted stock units, and options to purchase 238,524 shares of common stock. [Item 2.05]

The filing states that Citigroup, BNP PARIBAS, Deutsche Bank Securities, and HSBC are joint book-running managers for the offering. [Page 34]

According to the filing, MSD Netherlands Capital B.V., a wholly-owned finance subsidiary of Merck incorporated under the laws of the Netherlands, is also offering notes that will be fully and unconditionally guaranteed by Merck. [Prospectus, page 2] [Page 33]

The filing states that the United States and the Netherlands currently do not have a treaty providing for the reciprocal recognition and enforcement of judgments, other than arbitration awards, in civil and commercial matters. [Page 33] Consequently, a final judgment for the payment of money rendered by any court in any federal or state court in the United States based on civil liability, whether or not predicated solely upon U.S. securities laws, would not automatically be recognized or enforceable in the Netherlands. [Page 33]

According to the filing, Merck completed the spin-off of products from its women's health, biosimilars and established brands businesses into Organon & Co. on June 2, 2021. [Prospectus, page 1]

Source: SEC 424B5 filed 2025-12-03

Items cited: Cover Page, Prospectus Supplement pages S-2, S-3, Page 33, Page 34, Prospectus pages 1, 2, Item 2.05

Not investment advice.

Member discussion: